Foreign investment: why choose France?

France currently boasts a very strong image for foreign investors. Kearney’s annual survey has ranked the country among the top 5 most attractive destinations for major international investors since 2018[1].

FOREIGN INVESTMENT: WHY CHOOSE FRANCE?

Foreign decision-makers rank France as the second most attractive country in Europe (35%), behind Germany (41%) but ahead of the United Kingdom (34%)[2]. They highlight the quality of the workforce, the upscaled products (the luxury goods industry, gastronomy and agri-foodstuffs, etc.), digitalisation of industrial processes and the quality of French-style management [3].

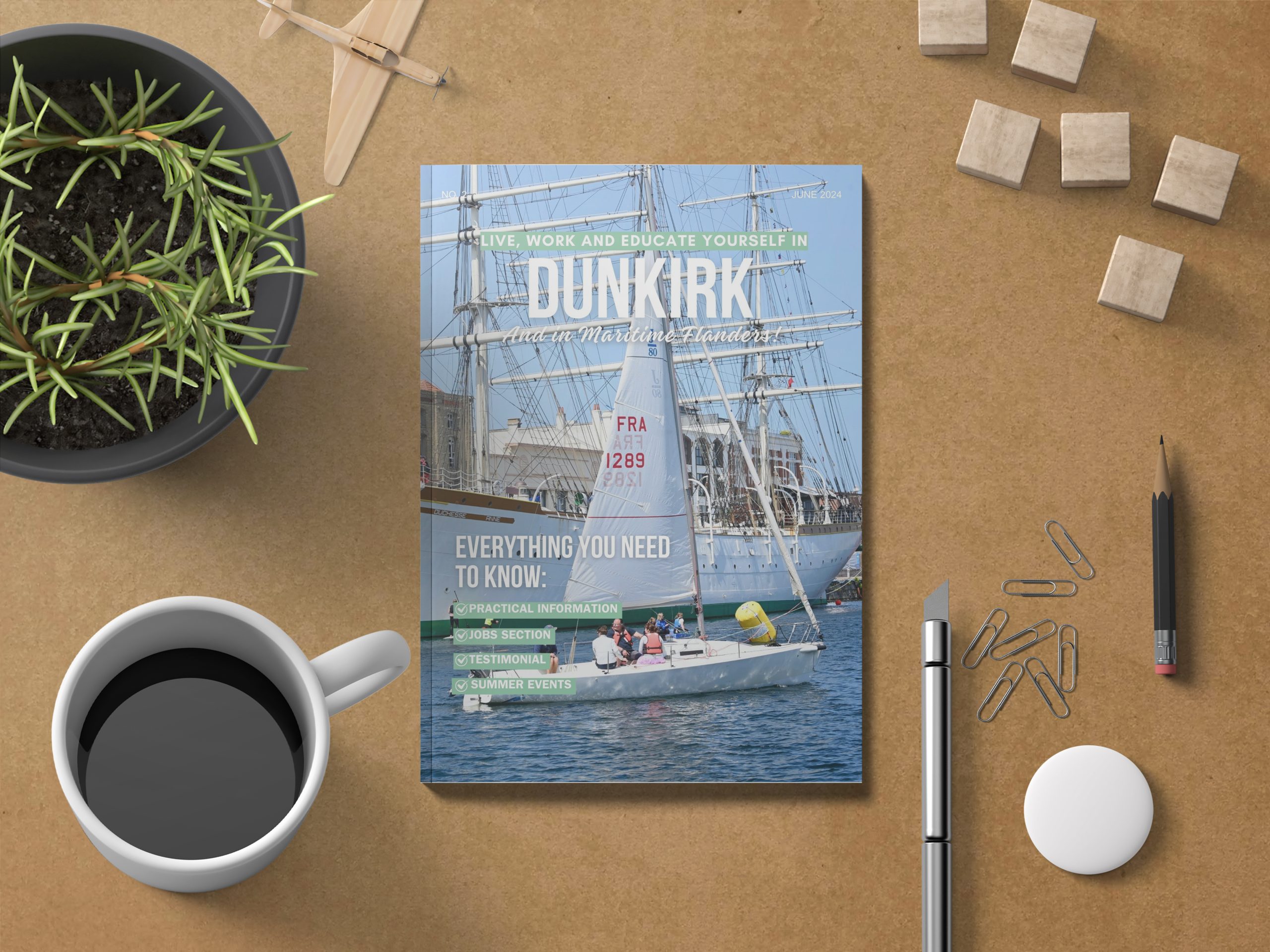

What are France’s assets and why should you invest there? You’ll get a full review with Dunkerque Promotion, an economic development agency that supports companies with their new expansion or subsidiary opening projects in Maritime Flanders.

France is attracting more and more foreign investors

In 2020, France received 985 foreign investment projects compared to 975 in the United Kingdom and 930 in Germany [4].

The country remains the number one European destination for foreign investments. It occupied the first place in the ranking in 2019[5].

Established foreign investors also tend to expand their business activity. According to Business France, 1,298 investment decisions created or maintained 33,489 jobs in 2017 (compared to 1,117 decisions and 30,108 jobs in 2016).

Invest in France: a dynamic growth market at the heart of Europe

France’s GDP reached 2,762 billion dollars at current prices in 2019[6]. That makes it the 7th largest global economy after the United States, China, Japan, Germany, India and United Kingdom (IMF, April 2019) [7].

France also has the second largest domestic market in Europe with more than 67 million consumers.

Furthermore, 89% of international business directors established in France state the size of the domestic market as a determining factor in their business plan[8].

Transport and logistics: high level infrastructures

France is a strategic crossroads at the heart of Europe. 81% of foreign companies operating in France choose the country for its export facilities to the rest of the continent[9], and 70% to Africa.

Open on several maritime fronts (the Atlantic Ocean, the Mediterranean Sea, the English Channel and the North Sea, etc.), France has a total of 66 commercial seaports[10]. In total, mainland France has 7 Grand Port Maritimes9bis, the top 3 of which are Marseille, Le Havre and Dunkirk. The territory has a dense road network, comprising 142 motorways for a total of 11,882 kilometres of road[11].

Thanks to the availability of land, it is easy to set up your company close to a train station, port, motorway or even an airport.

Human resources and innovation: a large choice of top talent

France makes huge investments in education and training (5% of GDP) [12]. 44.7% of the population of 25-34 year olds and 33.5% of the population of 25-64 year olds are university graduates[13]. The training and qualifications of France’s workforce influenced the decision of 86% of foreign entrepreneurs to set up a business in the country.

In terms of R&D, France’s appeal lies in its network of clusters (laboratory groups) and its centres of excellence [14]. The country also benefits from a positive image abroad in terms of inventiveness and innovation. “French inventive spirit”, a frequently used expression, corresponds to the actual perception that influences the decision of numerous foreign investors.

There is a lot of funding available to foster innovation and the research and development sector. These include:[15]

- The French Tech grant, paid by the French public investment bank (Bpi France) to support the preliminary technical and economic study of an innovative project.

- Feasibility and innovation funding (AFI), another subsidy or recoverable advance from Bpifrance to help project leaders to check the technical and regulatory feasibility of their project.

- Development and innovation funding, in the form of a recoverable advance or a loan for a maximum amount of 3 million euros.

- Regional innovation partnership funding (PRI), in association with government departments and certain regions.

- Numerous regional subsidies, such as the Territories Innovation Check in the Pays-de-la-Loire region and even Innov’up in Ile-de-France region.

- R&D tax credits (CIR) and innovation tax credits (CII), providing the companies who make investments in research and development during the year with substantial fiscal advantages.

- In the Hauts-de-France, the SME regional development fund (DINS) is a repayable advance for investment projects worth a minimum of €200,000 awarded to industrial enterprises and €50,000 to enterprises in the services sector. The amount can reach 30 to 50% of the company’s investment effort[16].

A strong-willed policy to support economic activity

Multiple and complementary financial aids

Setting up a business in France can give rise to diverse subsidies and financial aids awarded by the State, regions and even agglomerations and intercommunal structures. They are allocated on a case-by-case basis and depend on different criteria, such as:

- The size of the company,

- Its sector of activity,

- The nature of the project (creation, expansion, modernisation, etc.),

- The number of jobs created over an estimated given period (generally 3 years).

It is possible to benefit from certain financial aids depending on the location of the establishment, for example:

- In the special tax concession zones in cities (ZFU), with 100% exemption from tax on profits for 5 years[17],

- In the priority areas of the town (QPV), with full exemption from local tax for 5 years[18],

- In Rural Regeneration Areas (ZRR), with full exemption from the payment of tax on profits and local tax for 5 years[19],

- In regionally aided areas (AFR), enterprises may qualify for varying degrees of support in the form of tax exemptions depending on their location, the amount of the investment or even the size of the enterprise, in mainland France or in an overseas department. 18b

In practice, identifying the full list of financial aid to which a company is entitled is a complex task. Resorting to a local economic development agency, such as Dunkerque Promotion concerning Maritime Flanders, is generally recommended in order to benefit from local expertise and all the financial and administrative support available.

A unique repertoire of public financial aids for enterprises, compiled by CMA France, is also available here if you wish to research it yourself.

Targeted support for strategic activities

The French public authorities actively encourage the development or re-establishment of economic activities a.k.a. “strategic” activities on the national territory. Drawn up in response to the health crisis, the intention of the France Relance economic recovery plan is to strengthen France’s industrial autonomy.

A global call for projects was then launched on 31 August 2020. It enables interested investors to benefit from a significant subsidy in several key sectors [20].

- Aeronautics

- Automobile

- Nuclear power

- Agri-foods

- Health

- Electronics

- “Essential industrial inputs” (chemistry, materials, metals, etc.)

- 5G telecommunications

Boxed text: France Relance: a particularly ambitious financial envelope

Presented to the Council of Ministers on 3 September 2020, the France Relance economic recovery plan represents an exceptional public investment effort to help companies emerge from the health crisis. With an amount of 100 billion euros, it is intended to fund three priority areas[21]:

- The ecological transition (30 billion euros),

- Excellence and innovation (34 billion euros,)

- Social and territorial cohesion (36 billion euros).

Economic support for ecological transition industrial projects

The section of the France Relance economic recovery plan dedicated to the ecological transition contains a large number of financial measures and aids for enterprises that agree to use more energy efficient industrial processes. This includes[22]:

- “Bespoke” investment aid for complex projects aimed at improving the energy efficiency of manufacturing processes, when the amount allocated by the industrialist exceeds 3 million euros,

- Specific financial aid for industrial process decarbonisation projects,

- Financial aid for the implementation of industrial biomass heat,

- Financial aid for industrial heat mechanisms using solid recovered fuel (CSR).

Finally, a new subsidies office provides entrepreneurs with clear and centralised information on the equipment and investments under 3 million euros eligible for public funding[23]. You will find all the information necessary concerning this new service by consulting this online note.

Personalised support for investors

In addition, France has implemented specific support mechanisms for investors wishing to develop their business and open an enterprise or subsidiary in France. This includes:

- Launched by Business France in 2020 as part of the France Relance economic recovery plan, the “Welcome to France” online platform contains information for foreign enterprises and talent that wish to set up in France[24].

- The “skills and talent” residence permit, introduced in 2006 to make it easier for business people, whose projects can contribute to the economic development of France and their country of origin, to set up[25].

Located in the heart of Maritime Flanders and at the crossroads of Europe, Dunkirk is distinguished by a local industrial culture strongly rooted in its history. Companies already in business in the sector also underline the quality of the workforce, its availability and a proven work ethic. According to the OECD, France will rank fifth in the world in terms of employee productivity in 2021, with a contribution to GDP of €70 per worker and per hour worked[26].

Dunkerque Promotion economic development agency supports set-up projects in the region of Dunkirk and Maritime Flanders.

***

Key points to remember:

- France provides an exceptionally favourable environment for setting up a company and economic development.

- The country is characterised by the diversity of its financial aid and support mechanisms for investors.

- Resorting to a local economic development agency will help you to use more effectively all the levers available and save precious time.

SOURCES

[1] https://www.diplomatie.gouv.fr/fr/venir-en-france/entreprendre-et-investir-en-france/#sommaire_1

[2] https://www.gouvernement.fr/la-france-attire-de-plus-en-plus-d-investisseurs-etrangers

[3] https://www.gouvernement.fr/la-france-attire-de-plus-en-plus-d-investisseurs-etrangers

[4] https://www.leparisien.fr/economie/investissements-etrangers-la-france-reste-le-pays-le-plus-attractif-deurope-07-06-2021-FAVKUPSNIVBHTJV2MPPBZ6TORI.php

[5] https://www.leparisien.fr/economie/investissements-etrangers-la-france-reste-le-pays-le-plus-attractif-deurope-07-06-2021-FAVKUPSNIVBHTJV2MPPBZ6TORI.php

[6] https://www.diplomatie.gouv.fr/fr/venir-en-france/entreprendre-et-investir-en-france/#sommaire_1

[7] https://www.diplomatie.gouv.fr/fr/venir-en-france/entreprendre-et-investir-en-france/#sommaire_1

[8] https://www.gouvernement.fr/la-france-attire-de-plus-en-plus-d-investisseurs-etrangers

[9] https://www.gouvernement.fr/la-france-attire-de-plus-en-plus-d-investisseurs-etrangers

9bis https://fr.wikipedia.org/wiki/Grand_port_maritime

[10] https://www.ecologie.gouv.fr/acteurs-reseau-et-activites-portuaires-en-france

[11] https://fr.wikipedia.org/wiki/R%C3%A9seau_autoroutier_fran%C3%A7ais

[12] https://www.diplomatie.gouv.fr/fr/venir-en-france/entreprendre-et-investir-en-france/#sommaire_1

[13] https://www.diplomatie.gouv.fr/fr/venir-en-france/entreprendre-et-investir-en-france/#sommaire_1

[14] https://www.gouvernement.fr/la-france-attire-de-plus-en-plus-d-investisseurs-etrangers

[15] https://bpifrance-creation.fr/encyclopedie/aides-a-creation-a-reprise-dentreprise/aides-a-linnovation/recapitulatif-principales

[16] https://guide-aides.hautsdefrance.fr/spip.php?page=dispositif&id_dispositif=680

[17] https://www.service-public.fr/professionnels-entreprises/vosdroits/F31149

[18] https://www.service-public.fr/professionnels-entreprises/vosdroits/F34020

[19] https://www.service-public.fr/professionnels-entreprises/vosdroits/F31139

18bhttps://www.economie.gouv.fr/entreprises/exonerations-impots-zones-afr-zafr

[20] https://www.entreprises.gouv.fr/fr/aap/france-relance/appel-projets-france-relance-secteurs-strategiques-de-l-industrie

[21] https://www.vie-publique.fr/questions-reponses/280857-plans-de-relance-economique-france-relance-et-next-generation-eu

[22] https://www.asp-public.fr/aide-en-faveur-des-investissements-de-decarbonation-des-outils-de-production-industrielle

[23] https://www.asp-public.fr/aide-en-faveur-des-investissements-de-decarbonation-des-outils-de-production-industrielle

[24] https://cr.ambafrance.org/Welcome-to-France-information-a-destination-des-entreprises-et-des-talents

[25] https://www.immigration.interieur.gouv.fr/Archives/Les-archives-du-site/Archives-Immigration/Archives-Immigration-professionnelle/La-carte-de-sejour-competences-et-talents

[26] https://fr.statista.com/infographie/19072/productivite-horaire-du-travail-par-pays/

-

Chapters

- FOREIGN INVESTMENT: WHY CHOOSE FRANCE?

- France is attracting more and more foreign investors

- Invest in France: a dynamic growth market at the heart of Europe

- Transport and logistics: high level infrastructures

- Human resources and innovation: a large choice of top talent

- A strong-willed policy to support economic activity

- Targeted support for strategic activities

- Personalised support for investors